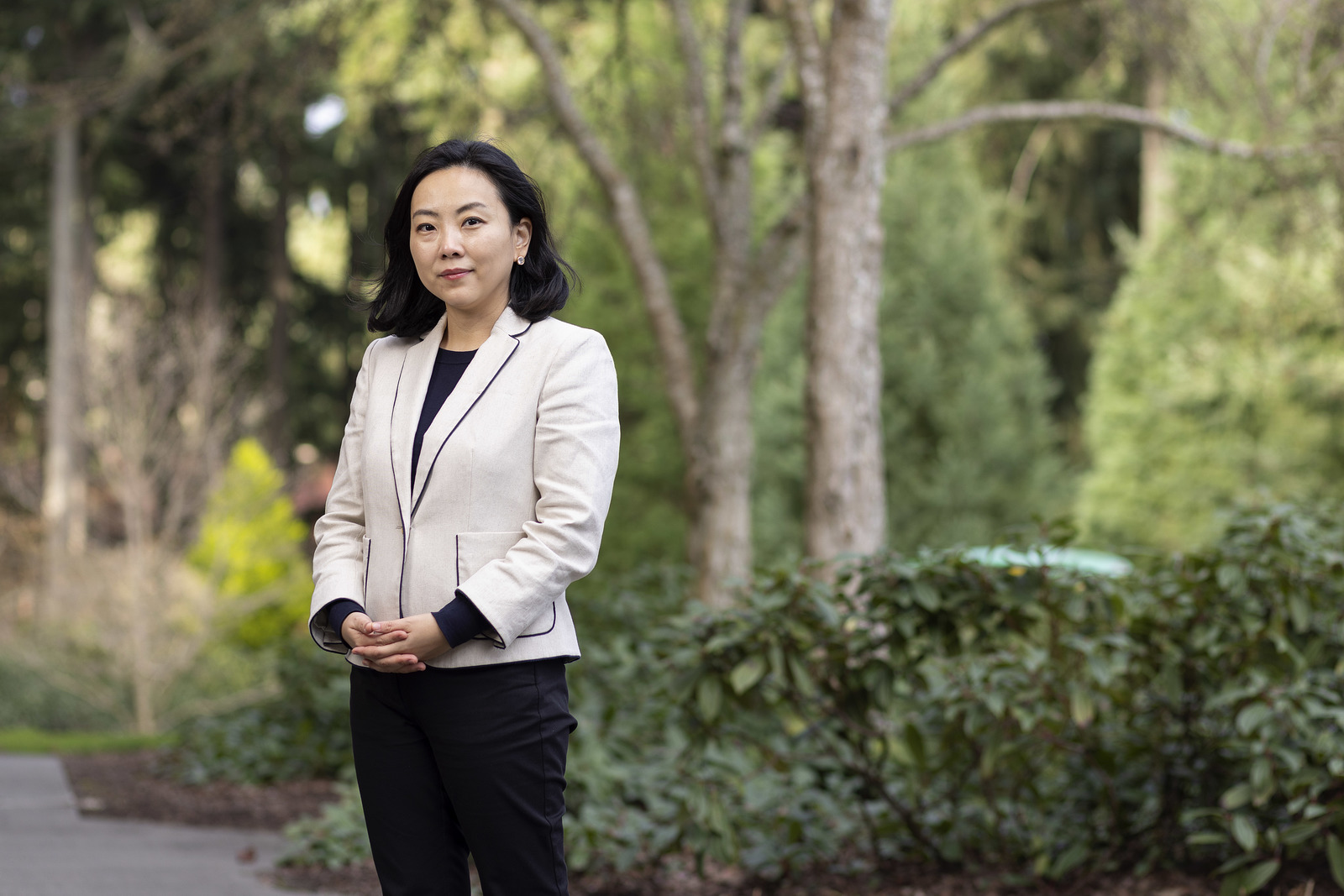

Sun Young Ahn, Nat S. and Marian W. Rogers Professor of Business and Leadership, says consumers need to be smart when opening their digital wallets.

WHAT THE RESEARCH SAYS

Ahn investigated how 20,000 consumers pay their bills—especially those who used digital wallets like Apple Pay and Google Pay—and how that correlated to their overall financial health. Her team found that those who use mobile payment methods were more likely to have excess credit usage and trouble managing money. It might be that people with less financial savvy are turning to payment apps to help improve their situation—but another explanation for the findings could be that technology makes it a little too easy to spend. Says Ahn: “Mobile payments are even less tangible than a credit card.”